2.

There are 2 common methods investors use to make money in the stock market. The 1st is fundamental analysis which was elaborated in Part 1.

The 2nd method to making money in the stock market is technical analysis. Is technical analysis relevant? Is technical analysis nothing more than a short-cut?

Let’s explore technical analysis below.

#1 What Is Technical Analysis?

Technical analysis is the study of the share price of a company. Practitioners of technical analysis believe that all news, information, and views regarding a stock have been baked into its share price. Therefore, they study the price movement of a company and follow the trend of prices.

When prices are heading higher, investors using technical analysis will be looking for buying opportunities. When prices are declining, investors using technical analysis will be looking for short-selling opportunities to make money.

This means that the duration of the investment can be as short as a few weeks to as long as a couple of years.

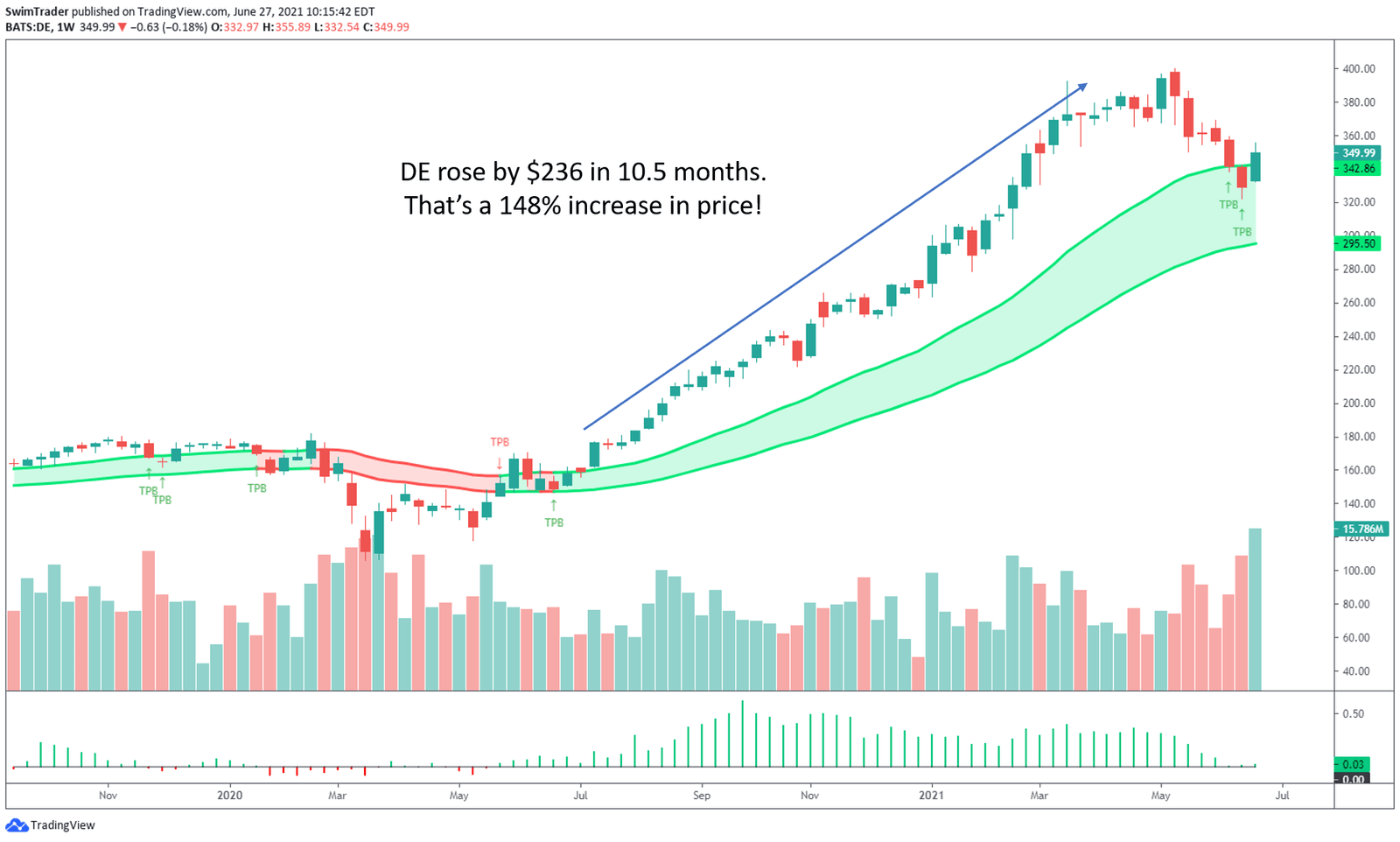

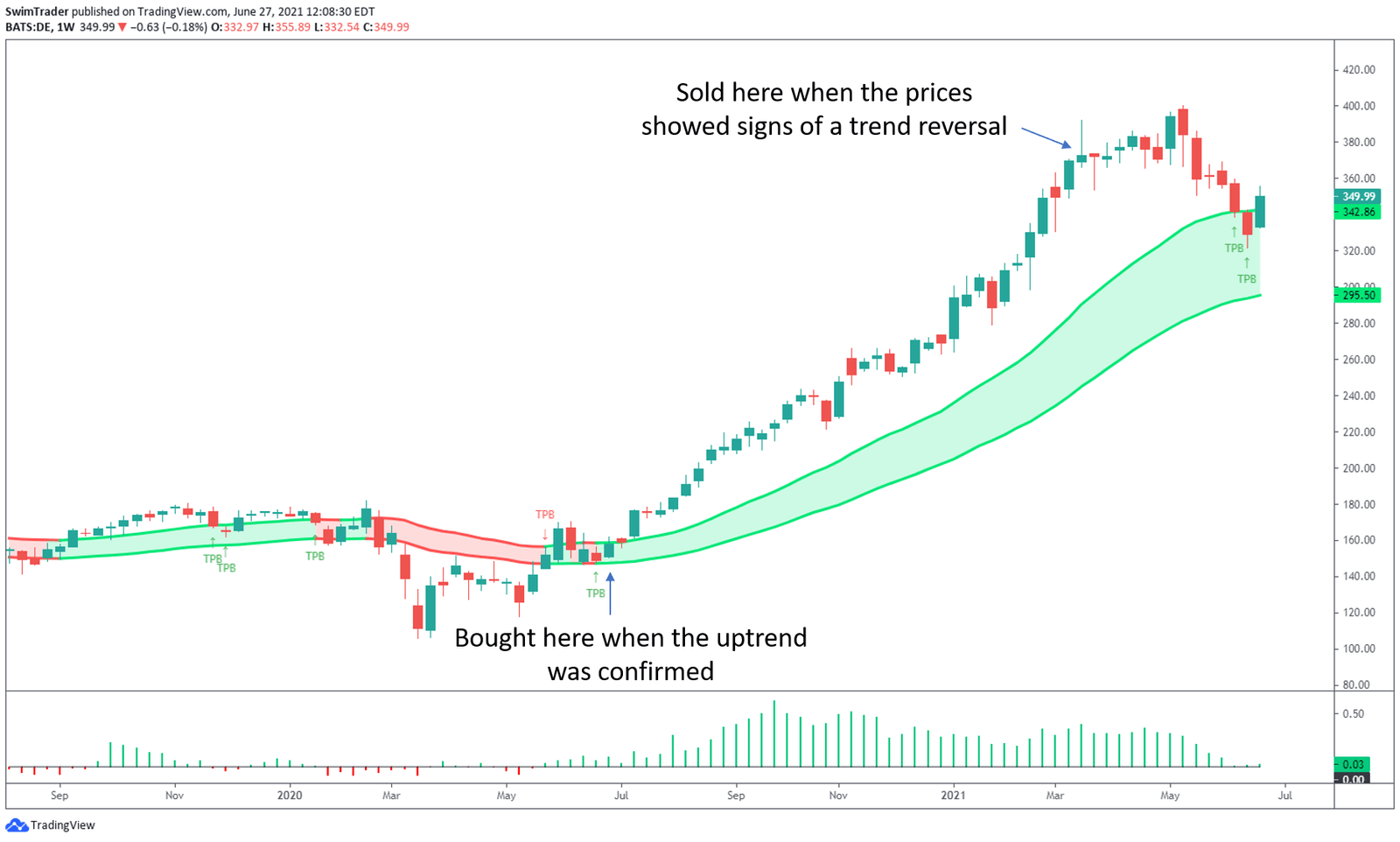

Let’s have a look at the weekly chart of Deere & Company (DE) from 2020 to June 2021.

From the weekly chart of DE above, it was ripe for a weekly TPB (Trend Pullback) swing trade in June 2020. Prices were recovering from the crash caused by COVID-19.

I bought shares of DE and held it as prices rose all the way to Apr 2021. Optimism seemed to be fading from the size of the candlesticks in Mar and Apr 2021 which led me to sell my holdings in DE.

This looks easy huh? Without the necessary skills, it spotting a potentially powerful stock can be tough.

#2 What You Need To Become A Successful Investor Using Technical Analysis?

What does it take to become a successful investor using technical analysis?

a) Patience

b) Attention to detail

c) Analytical mind

d) Psychology

Let’s explore each required ingredient for success.

a) Patience

To be successful in the stock market (regardless in the short or long-term), you have to be patient. What do you wait for?

You wait for confirmation that prices of the stock is forming a new trend and going in the direction you’d predicted. With this confirmation comes less heartache and emotional scars.

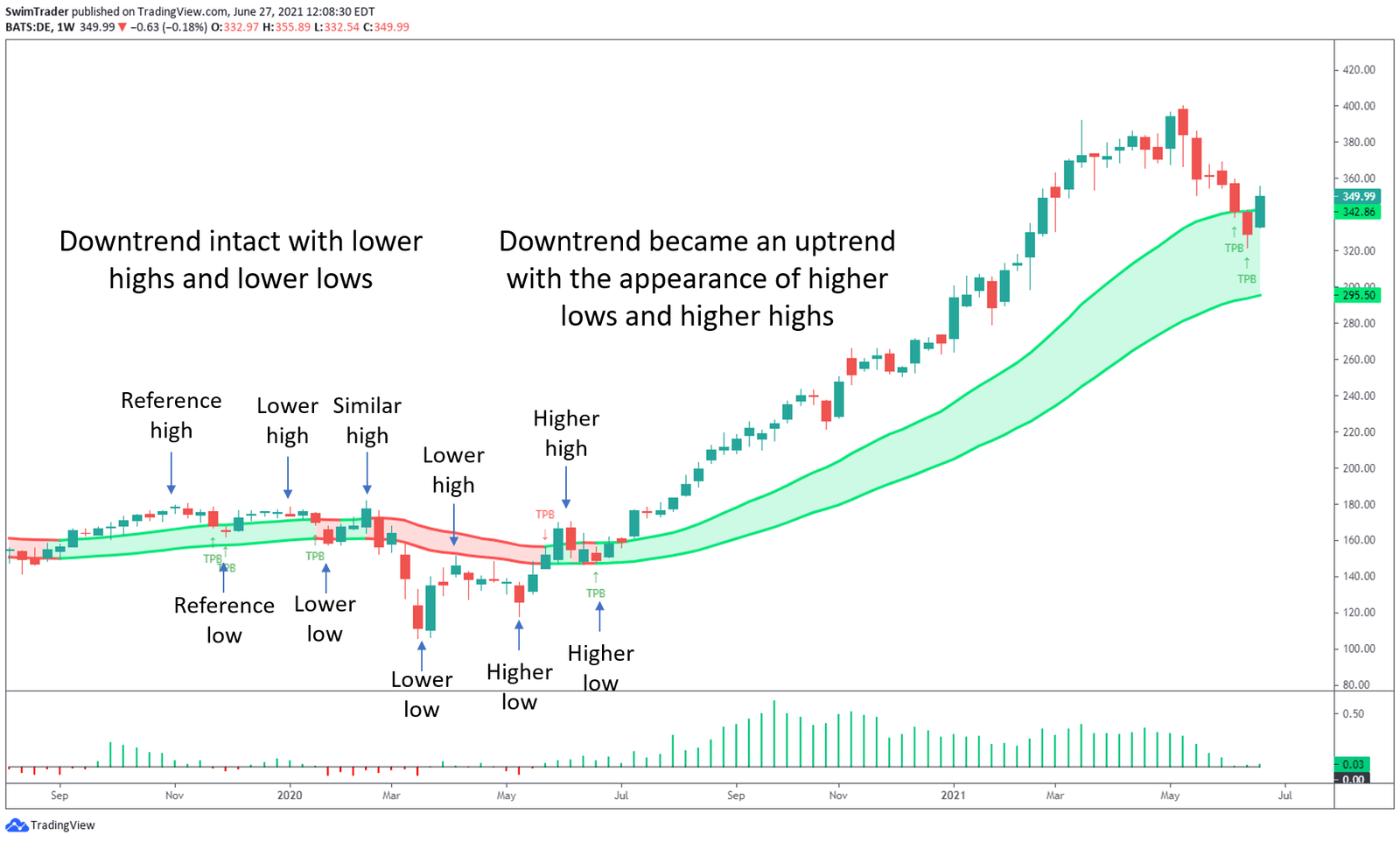

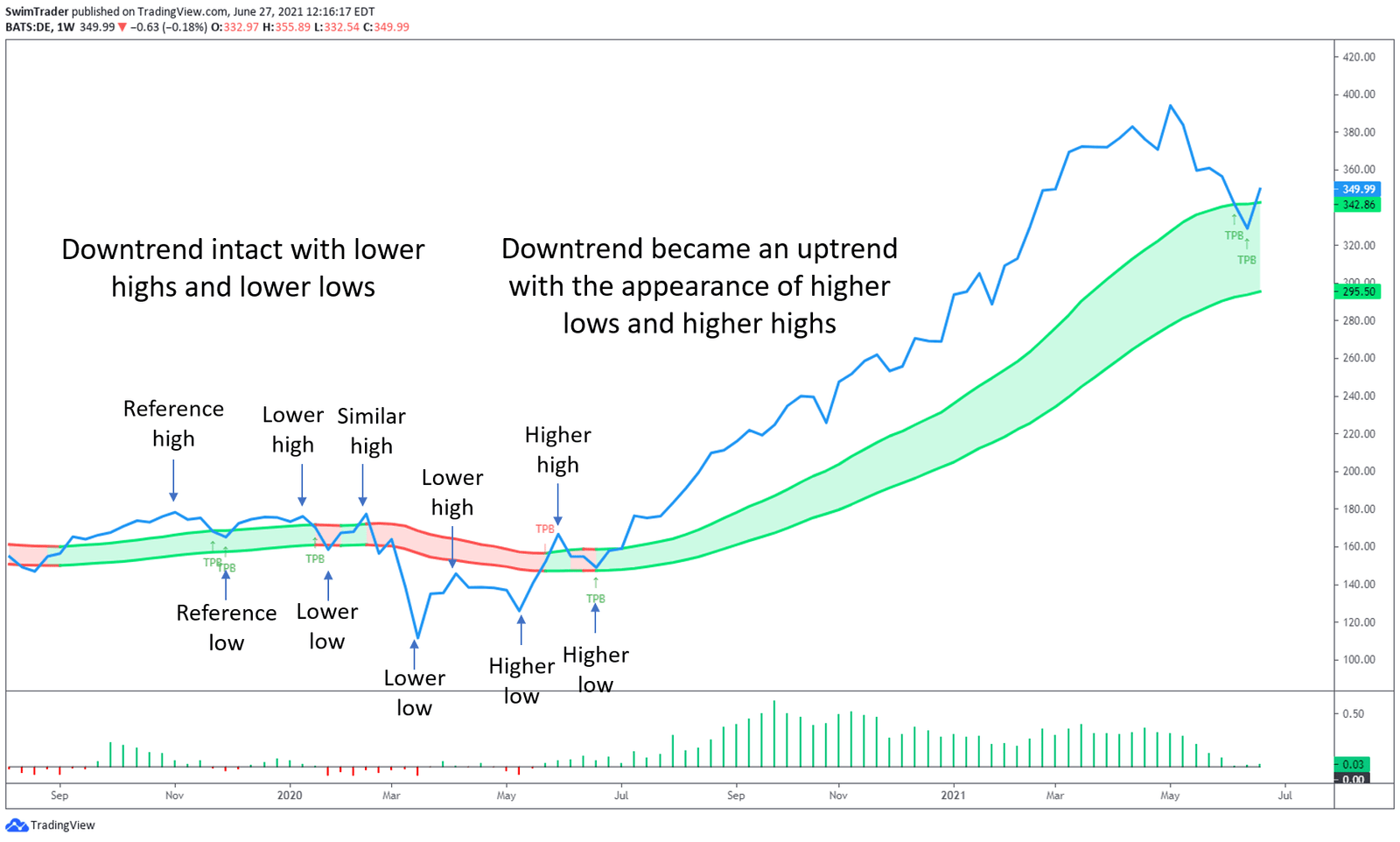

Can you tell when the price of a company is trending up or down?

A company’s share price is in an uptrend if its prices are forming higher highs and higher lows.

A company’s share is in a downtrend when its prices are forming lower highs and lower lows.

I have 2 illustrations of DE below, displayed with candlesticks and line charting styles to help you visualize.

b) Attention to detail

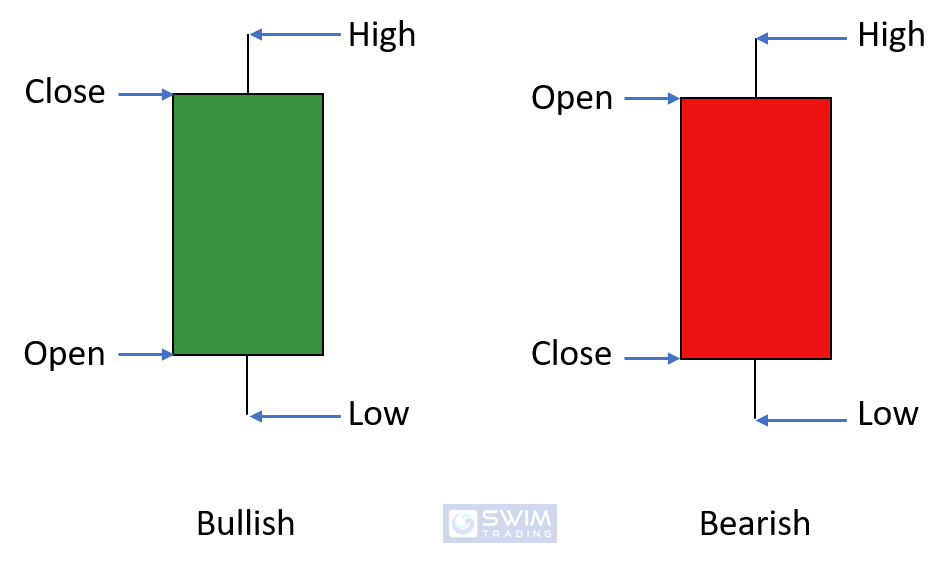

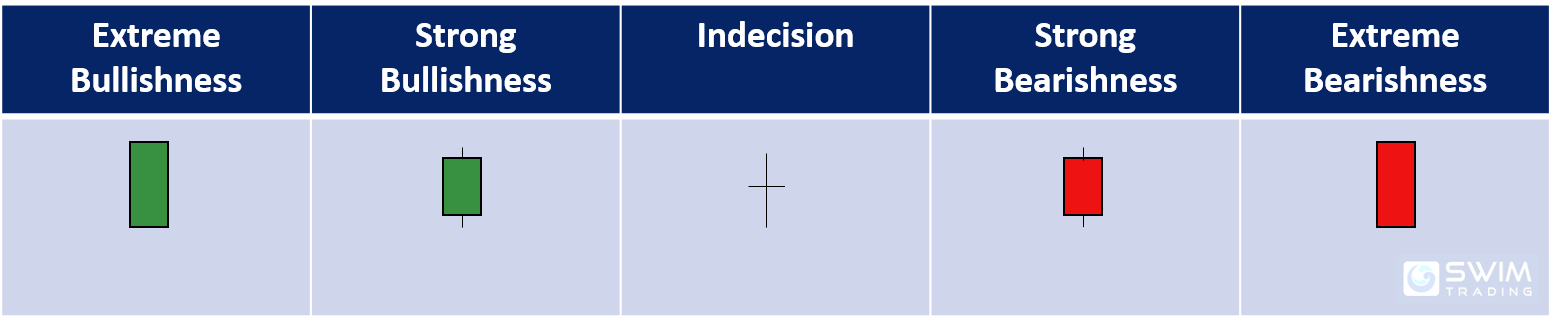

An investor applying technical analysis needs to pay attention to details. S/he needs to learn how to read candlesticks before making a calculated bet.

What can you tell from a candlestick?

In addition to the price levels, you can also infer the intensity of the beliefs of other investors. A small green candlestick would mean that the market is barely optimistic, while a large green candlestick signifies huge optimism.

Similarly, a small red candlestick represents slight pessimism as compared to a large red candlestick which signifies grave pessimism.

You can learn more about candlesticks and how you can apply candlestick patterns to aid your investing journey here.

c) Analytical mind

Besides reading candlesticks alone, you’ll need to analyze the larger picture. This means reading candlesticks in clusters and in conjunction with a pair of indicators such as Volume and MACD (Moving Average Convergence and Divergence).

Pairing candlesticks with indicators enable you to have a fuller understanding of a stock, hence further reducing your risk.

d) Psychology

You’ll need to be aware of your emotions, thoughts, surroundings as these factors can affect your trading psychology.

Would you be able to perform your research and analysis better in a quiet room or with a quarrel going on?

Would you be able to perform your research and analysis better when you are worried or excited?

With a clear mind, neutral emotion, and familiar surroundings, your results from the stock market will be more consistent.

One way to grow in your psychology is to journal before and after every investment. Make sure you have these 6 points in your trading journal!

#3 Who Are The World’s Most Successful Investors Using Technical Analysis?

a) Ray Dalio

Ray Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund firm.

He is also the author of Principles, Big Debt Crises, The Changing World Order, and more.

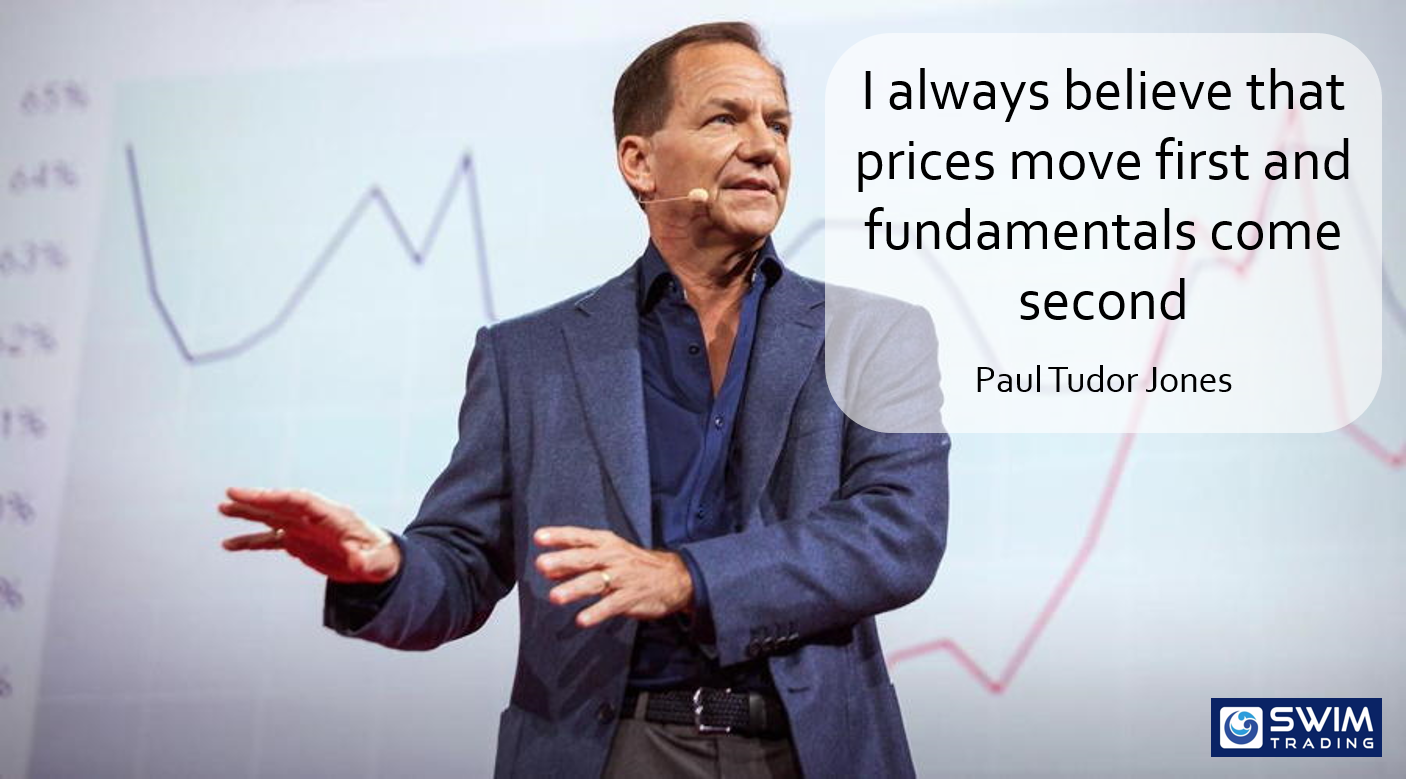

b) Paul Tudor Jones II

Paul Tudor Jones II is one of the pioneers of the modern-day hedge fund industry.

He predicted Black Monday in 1987 and tripled his money. He had also foreseen the collapse of Japan’s stock market, making a 87.4% return.

He’s also featured in the book Market Wizards by Jack D Schwager.

c) Ed Seykota

Ed Seykota is famously remembered for the following sayings:

“Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win big by losing money.”

“Risk no more than you can afford to lose and also risk enough so that a win is meaningful.”

“Until you master the basic literature and spend some time with successful traders, you might consider confining your trading to the supermarket.”

His success led him to be featured in the book Market Wizards by Jack D Schwager.

#4 When Do Investors Sell Their Stocks?

Do you remember how to read a trend? Prices are in an uptrend when there are higher highs and higher lows.

On the other hand, prices are in a downtrend when there are lower highs and lower lows.

Investors using technical analysis follow the trend. Hence, they sell when the trend changes or start showing signs of an impending change.

Let’s look at DE again. I bought shares of DE when the uptrend was confirmed in June 2020. I sold it in March 2021 as prices suggested that a reversal was round the corner.

A side note: The indicators shown above are part of the TPB Swing strategy. They’re proprietary to Swim Trading.

5 Things You Must Remember

#1 Technical analysis is not a short-cut

#2 Technical analysts believe that all information and sentiment of a stock is baked into its price

#3 You’ll need patience, be detail-oriented, have an analytical mind, and understand your psychology to succeed

#4 The world’s top investors using technical analysis include Ray Dalio, Paul Tudor Jones II, and Ed Seykota

#5 Investors sell their holdings when prices start to show signs of a change in trend or have changed in trend

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Go secure and build your wealth!