What comes to your mind when you hear the word “investment”?

Did you think of Warren Buffett? Or holding on to an asset for the long term?

Did fundamental analysis come to your mind?

Fundamental and technical analysis are the 2 most common ways you and I can make money in the stock and even cryptocurrency market. Let’s explore fundamental analysis in this article, and technical analysis in Part 2.

#1 What Is Fundamental Analysis?

Fundamental analysis is the study of a company’s value through its earnings results, pricing power, management, growth potential, the economic outlook, and more. After all, no one would like to invest in a company that’s a price taker or has razor-thin margins.

The goal of fundamental analysis is finding a solid company with growth potential to invest in. Fundamental analysts believe that companies with strong business fundamentals are poised to grow in the future, resulting in a rise in their share price.

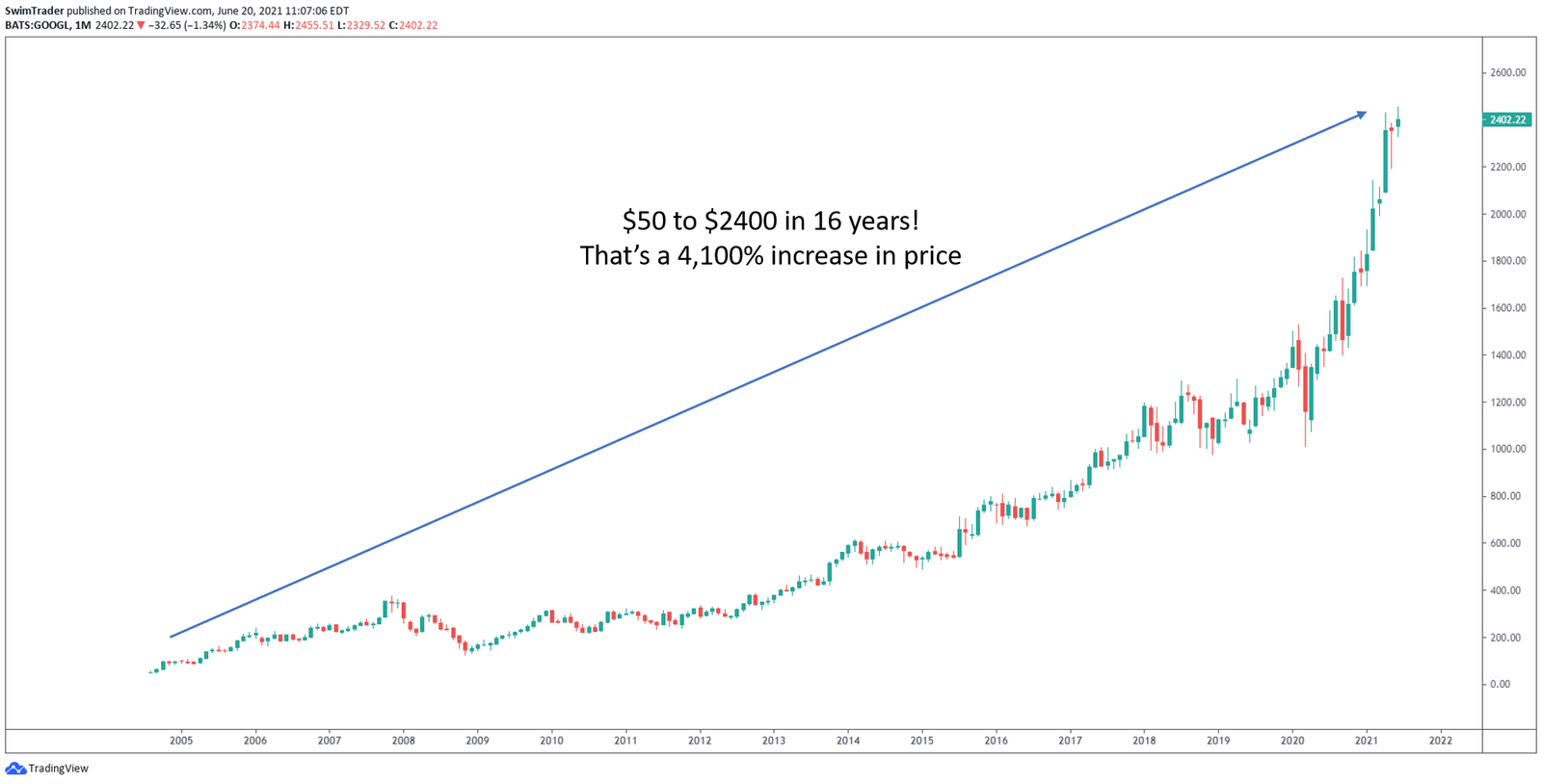

One shining star is Google. Here’s Google’s monthly chart.

#2 What You Need To Become A Successful Investor Using Fundamental Analysis?

To become a successful investor, you’ll need to know what it takes to be an investor.

Here’s a list of necessary ingredients:

a) Long-term mindset

b) Patience

c) Analytical mind

d) Attention to detail

e) Business acumen

Let’s examine each of the required ingredients to become a successful investor.

a) Long-term Mindset

Earning reports and the economic data are released every few months, or once a year.

The effects of management take months or even years to be realized and felt.

Products are launched every year or couple of years.

Do you remember that the above points affect the fundamentals of companies? Because the fundamentals of a company change slowly (quarters to years), you’ll need to develop a long-term mindset.

b) Patience

Fishing is one activity that I dislike. Being an active person, I can’t remain seated at a spot, waiting for a fish to bite. I’d go cray crazy!

Why is patience needed?

You’ll have to wait for months for data to be collated and released, spend hours to study the reports of companies and the economy, and for the right moment to buy the shares of the companies you’ve shortlisted.

Growth and price appreciation take time. In the case of Google, it pays to be super patient. If you’d bought shares of Google during it’s early days, you’d be reward with a 4,000+% profit!

A lack of patience could stem from the fear of missing out (FOMO) or greed. Read Part 1 and Part 2 to help you overcome FOMO and greed.

c) Analytical Mind

In reports, you’ll be presented with statistics and data. Therefore, you have to be equipped with basic accounting knowledge and possess an analytical mind to understand the financial health of a company.

You’ll need to make sense of the statistics presented and identify the relationship between the metrics and performance of the company.

An analytical mind is helpful in scrutinizing reports and forming your own conclusion.

d) Attention To Detail

The devil is in the details.

Reports can be misleading or even inaccurate. Hence, you’ll need to pay attention to detail.

e) Business Acumen

Change is the only constant in life. Having a sense of where the economy is headed in the near future will be critical.

You’ll be able to filter out certain sectors and industries which may benefit from the changing economy.

If you’d invested in data centers, Real Estate Investment Trusts (REITs), or healthcare companies in the past decade, you’d be grinning from ear to ear.

Which industries do you think are about to experience explosive growth in the next decade?

However, business acumen is needed beyond the ability to identify growth industries. As an investor, you’ll want to be experienced in spotting opportunities that companies can exploit with their current products and services.

Take Facebook as an example. Although Facebook is a social media giant, investing in Facebook isn’t equivalent to investing in social media.

What does Facebook collect? How do they collect it?

Investing in Facebook is investing in artificial intelligence (AI), big data, advertising, entertainment, and so much more!

#3 Who Are The World’s Most Successful Investors Using Fundamental Analysis?

Everyone knows that Warren Buffett is a top notch investor. Are there other notable successful investors?

a) Benjamin Graham

He’s the author of The Intelligent Investor and Security Analysis. Benjamin Graham is also the mentor of Warren Buffett.

b) Peter Lynch

He’s the inventor of price-to-earnings-growth ratio (PEG) to determine if a stock is undervalued against that company’s growth potential.

He has authored One Up On Wall Street and Beating The Street.

#4 When Do Investors Sell Their Stocks?

Do fundamental analysts sell their stocks?

Though Warren Buffett gives us the impression that he owns his stocks for life, this is not the case in reality.

In the recent crash caused by COVID-19 from Feb to Mar 2020, the legendary investor sold all or some of his holdings in the following industries – airlines and travel, banking and finance, oil and gas.

Why did Warren Buffett sell the stocks in those industries?

He figured that COVID-19 will have a large and long impact on travel, which includes flying.

As governments all around the world worked overtime to impose a lockdown and the handing out financial aid, he knew that most businesses would suffer. This would result in wider implications, esp in the banking and finance industry.

When a lockdown is imposed almost on a global scale, and simultaneously, demand for oil and gas will plummet. Employees will be working from home as much as possible, travel will not be reinstated anytime soon, and manufacturing output will be slashed. This meant that the demand for oil and gas will be just a fraction of that before the global pandemic emerged.

This huge economic shift shook the fundamentals of the mentioned industries, spurring him to sell them.

Want to know the differences between an investor and trader? This article will help shed some light.

5 Things You Must Remember

#1 You can be a successful investor using fundamental and/or technical analysis

#2 Fundamental analysis is the study of a company’s value and identifying its growth potential

#3 You’ll need to adopt a long-term mindset, be patient, possess an analytic mind, have a keen eye on details, and have good business foresight

#4 The world’s top investors using fundamental analysis include Warren Buffett, Benjamin Graham, and Peter Lynch

#5 Investors sell their holdings when there’s a significant change to the fundamentals of a company

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Go secure and build your wealth!