We are less than 5 days away from 2022!

Have you achieved your investment goals for 2021?

Through December 2021, I’ve been reflecting about 2021 and am thankful for your readership. Thank you for allowing me to be part of your stock and crypto investment journey!

Looking ahead, I foresee that there’ll be more volatility in the stock market. Does this mean that good opportunities will be far and between?

Nope! It just means that we need to be mentally and emotionally prepared.

Talking about that, I have 2 articles prepared to help you improve your trading psychology. Here’s Part 1 and Part 2 of how you can overcome fear and greed.

Are you ready to dive in to discover the 3 super stocks to make 2022 your best year yet? Please note that these stocks aren’t ranked in any particular order.

#1 Copart

Copart (CPRT) is an online vehicle marketplace in the US, UK, Republic of Ireland, Germany, Finland, Spain, Brazil, UAE, Oman, and Bahrain. Having a presence in multiple countries in Europe and the Middle East, CPRT boasts a market capitalization of over $34 billion!

A) Fundamental Analysis

CPRT’s revenue, net income, and profit margin have been increasing year after year, performing spectacularly well in the midst of the pandemic.

Its free cash flow has also grown over the years and remain steady in 2021.

How does CPRT stack against its industry peers?

CPRT has outperformed its peers in all 7 key financial metrics. Of which, CPRT has massively outperformed its industry peers by 20 or more percentage points in 3 of the 7 financial metrics. Is that mind blowing?

Shall we look at the chart of CPRT?

B) Technical Analysis

From CPRT’s weekly chart, we can tell that CPRT has been on a super strong uptrend before and after the COVID-19 crash. This can be inferred from the gradient and color (green) of the Value Zone indicator.

“Jay, can you please tell me more about the Value Zone indicator?”

Sure! I’ll share more details at the end of the article.

I believe that fundamental analysis and technical analysis can be used hand-in-hand to identify high probability winning stocks.

With solid fundamentals and technicals, I see a bright future for CPRT in 2022.

What’s the next super stock?

#2 Etsy

What does Etsy do?

Etsy (ETSY) is an online marketplace which operates in the US, UK, Canada, Germany, France, Australia, and more.

ETSY also provides its payment processing service, generate income from advertisements, dashboard tools for sellers, and more!

It’s therefore no wonder that ETSY is such a giant company with a market capitalization above $34 billion!

Does ETSY have strong business fundamentals?

A) Fundamental Analysis

ETSY’s revenue and net income have been rising year after year. Its profit margin took a dip in the recent years, but recovered spectacularly well in 2020.

Its free cash flow has swelled from $82.3 million in 2017 to a staggering $686.9 million in 2020!

Let’s examine how ETSY stack against its industry peers.

ETSY has outperformed its peers in all 7 key financial metrics. Of which, ETSY has massively outperformed its industry peers by 40 or more percentage points in 3 of the 7 financial metrics! No, there’s no typo.

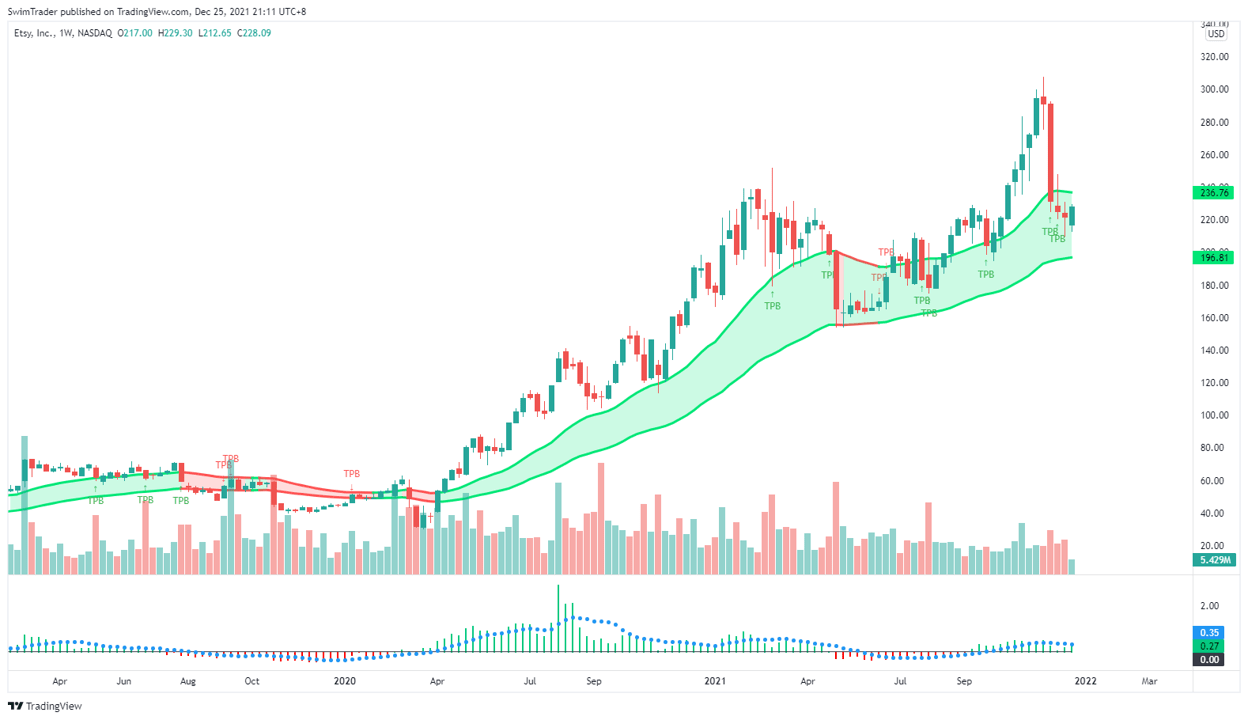

How does the weekly chart of ETSY look like?

B) Technical Analysis

ETSY has been soaring in price from 2020!

Similar to CPRT, ETSY is in the Value Zone indicator, suggesting that it could be ready for a buy in the weeks to come.

Having strong fundamentals and technicals, it’s worth paying attention to ETSY in early 2022 and catch this stock if it continues to climb.

#3 Realty Income

Realty Income (O) is a REIT (real estate investment trust) with more than 7,000 properties across the US and Europe.

O focuses on retail properties which makes up approximately 83% of its total revenue from rental.

This has allowed O to grow steadily to a market capitalization of $39 billion.

Let’s dive in to its fundamentals!

A) Fundamental Analysis

As expected, O’s net profit margin took a dip in 2020. However, this dip is considered to be shallow.

O’s revenue continues to grow, while net income has been stable from 2017 to 2020.

Free cash flow has increased from almost $3 billion in 2017 to $5.5 billion in 2019 before taking a hit in 2020, with $4.37 billion. That’s a pretty strong performance!

Despite the challenges brought by COVID-19, O has outperformed its peers in 6 out of 7 key financial metrics! O has massively outperformed its industry peers by 30 or more percentage points in 2 of the 7 financial metrics! It’s really no easy feat.

B) Technical Analysis

Here’s how the weekly chart of O looks like.

Being a REIT, the price appreciation of O is naturally slower than others such as CPRT and ETSY. But in exchange for a slower climb up, you’ll be paid dividends.

We can also tell that O has been on a steady uptrend since 2021. The price of O is near the Value Zone indicator too!

With its fundamentals and technicals looking strong, O could continue being a gem for passive income investors in 2022.

What Is The Value Zone Indicator?

Under the technical analysis segment of CPRT, I shared that the Value Zone indicator is helpful in 2 ways – its gradient and color.

When the gradient of the Value Zone indicator is sloping upwards and green in color, this means that the stock is in an uptrend; its prices are rising.

The opposite is true for a stock that’s in a downtrend. The gradient of the Value Zone indicator will be sloping downwards and red in color.

When the gradient of the Value Zone indicator is flat, regardless of its color, the stock is ranging.

These can be seen in the chart of O below.

The Value Zone indicator is part of the TPB Swing strategy.

Years of data has been studied to formulate the Value Zone indicator and TPB Swing strategy to result in a win rate of 71%.

Using the TPB Swing strategy, you’ll discover the financial metrics I use to measure the health of a company, and be equipped with technical analysis to help you filter for super stocks like CPRT, ETSY, and O.

In addition, you’ll receive a trade list every week by one of my coaches. This will save you a lot of precious time to achieve your other goals for 2022.

Is your goal in 2022 to learn how to trade profitably and consistently?

Make 2022 your best year yet by applying the coupon code “win2022” to get $300 off your purchase of the TPB Swing strategy. The coupon code “win2022” will expire on 31 Jan 2022.

4 Things You Must Remember

#1 Search for stocks with strong fundamentals

#2 Filter for stocks with strong technicals

#3 Super stocks such as CPRT, ETSY, and O have solid fundamentals and technicals

#4 Utilize the TPB Swing strategy to gain an unfair advantage and make 2022 your best year yet

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#2 Never miss another market update; get it delivered to you via Telegram by clicking here

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Cheers to a record breaking 2022!