“Daddy, look at my nails and lipstick!”

“Do I look pretty?”

“Girl, you are pretty even without any makeup.”

Do I win the Dad of the Year award?

Jokes aside, shall we analyze the stock pick of the week – Estee Lauder (EL)?

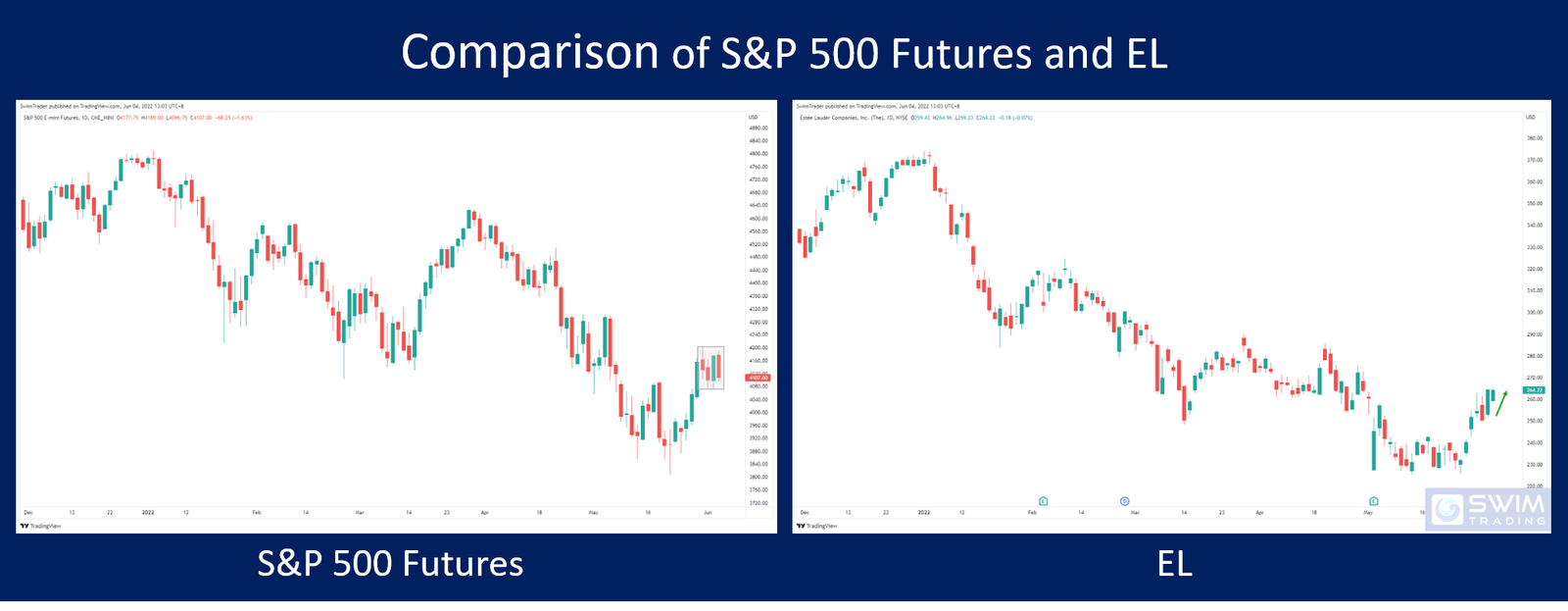

Performance Of US Stock Market vs Estee Lauder

Before you focus on Estee Lauder, it’s highly recommended to look at how the overall US stock market is performing as that’ll provide a larger picture.

How did the overall US stock market perform?

Looking at the S&P 500 futures, you can see that the overall US stock market went sideways, ranging between 4070 and 4200 (as shown by the gray box). In the longer term , the overall US stock market is still in a downtrend since the start of the year.

Did EL perform better?

For the past week, the price of EL rose. So, yes! EL fared better than the overall US stock market.

From the start of 2022, EL has been in a downtrend. However, a new uptrend is being formed at the present.

Can you see this?

Instead of squinting your eyes to read trends, you can use these 3 methods to read a trend under 5 seconds.

How Explosive Is EL?

Oh hang on, I haven’t properly introduced EL.

EL manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

It was founded in 1946 and now boasts a market capitalization of more than $94b, making it the world’s top 150 most valuable company.

In other words, EL is an established business with a huge market capitalization. Does this mean that the upward price movement of EL isn’t explosive?

Let’s find out.

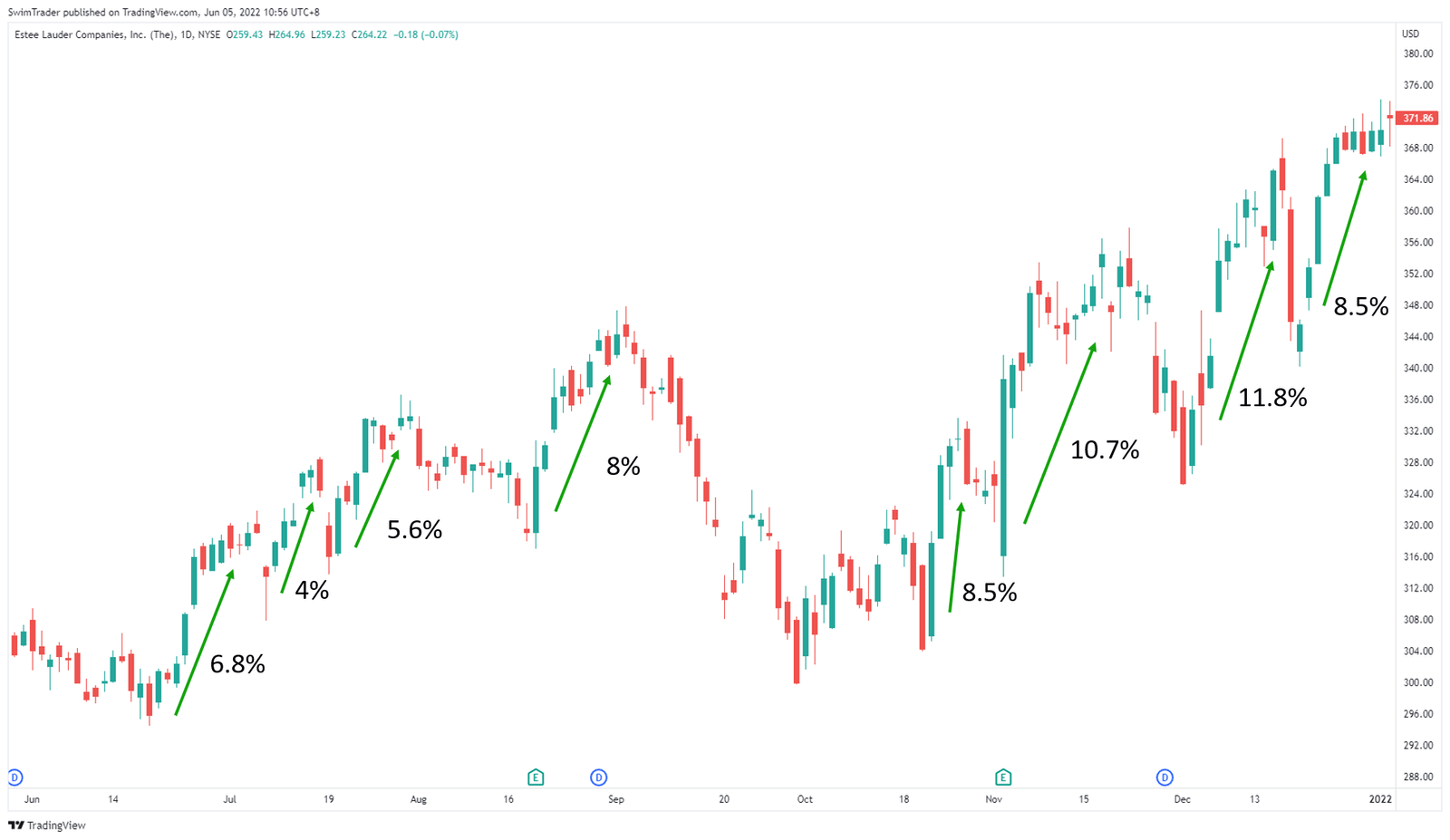

Here’s the chart of EL from Jun to Dec 2021, before the downtrend in 2022 began.

From the chart above, it’s evident that the upward movement of EL is explosive.

It has shot up 8 times, with each upward movement measuring between 4 and 11.8%! This is fantastic for a stock that was priced at $300+ back then.

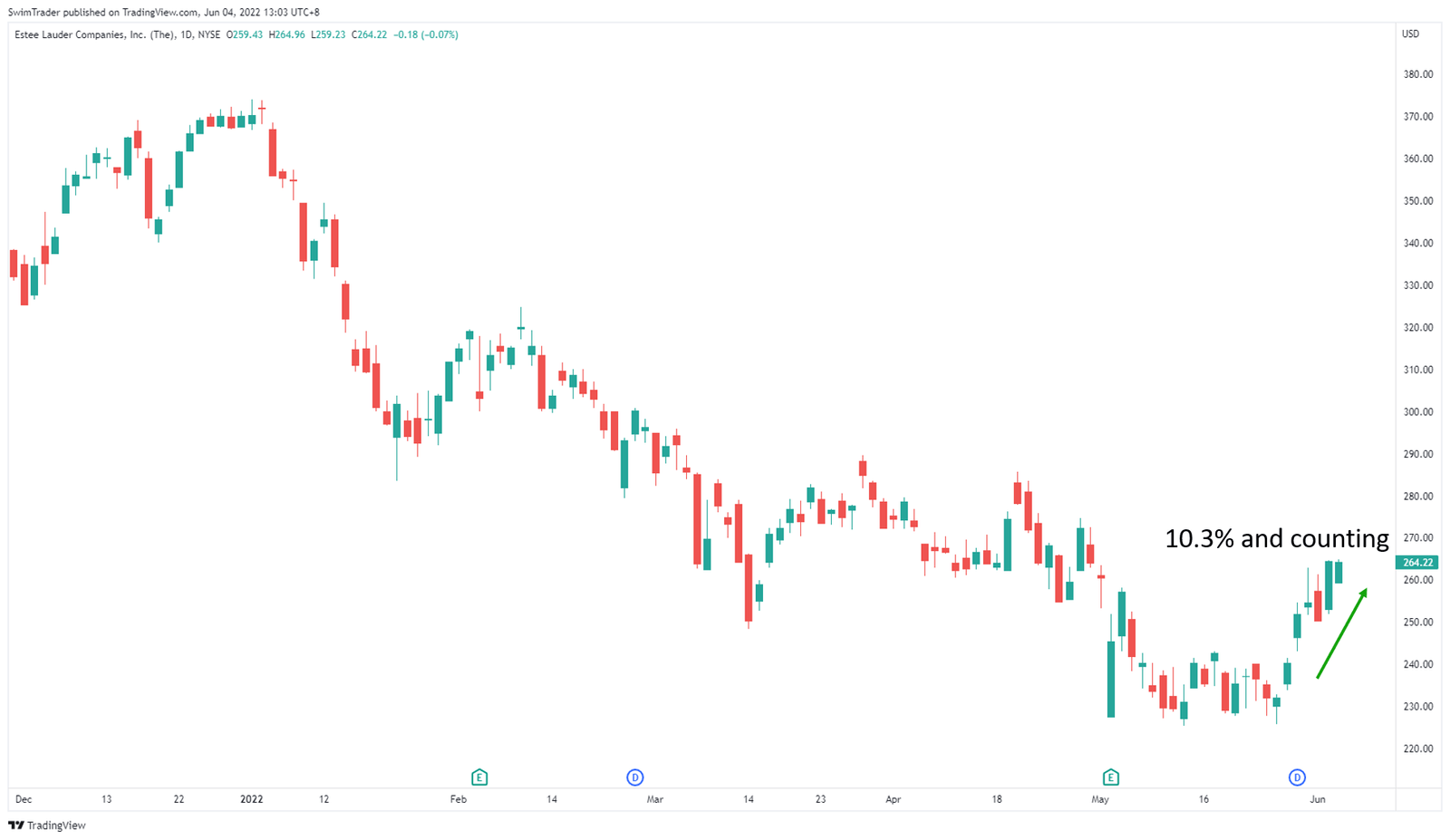

Do you remember that EL is in a new uptrend?

Let’s measure its current up move.

The latest upward movement of EL measures a popping 10.3% and counting!

EL is indeed capable of explosive up moves.

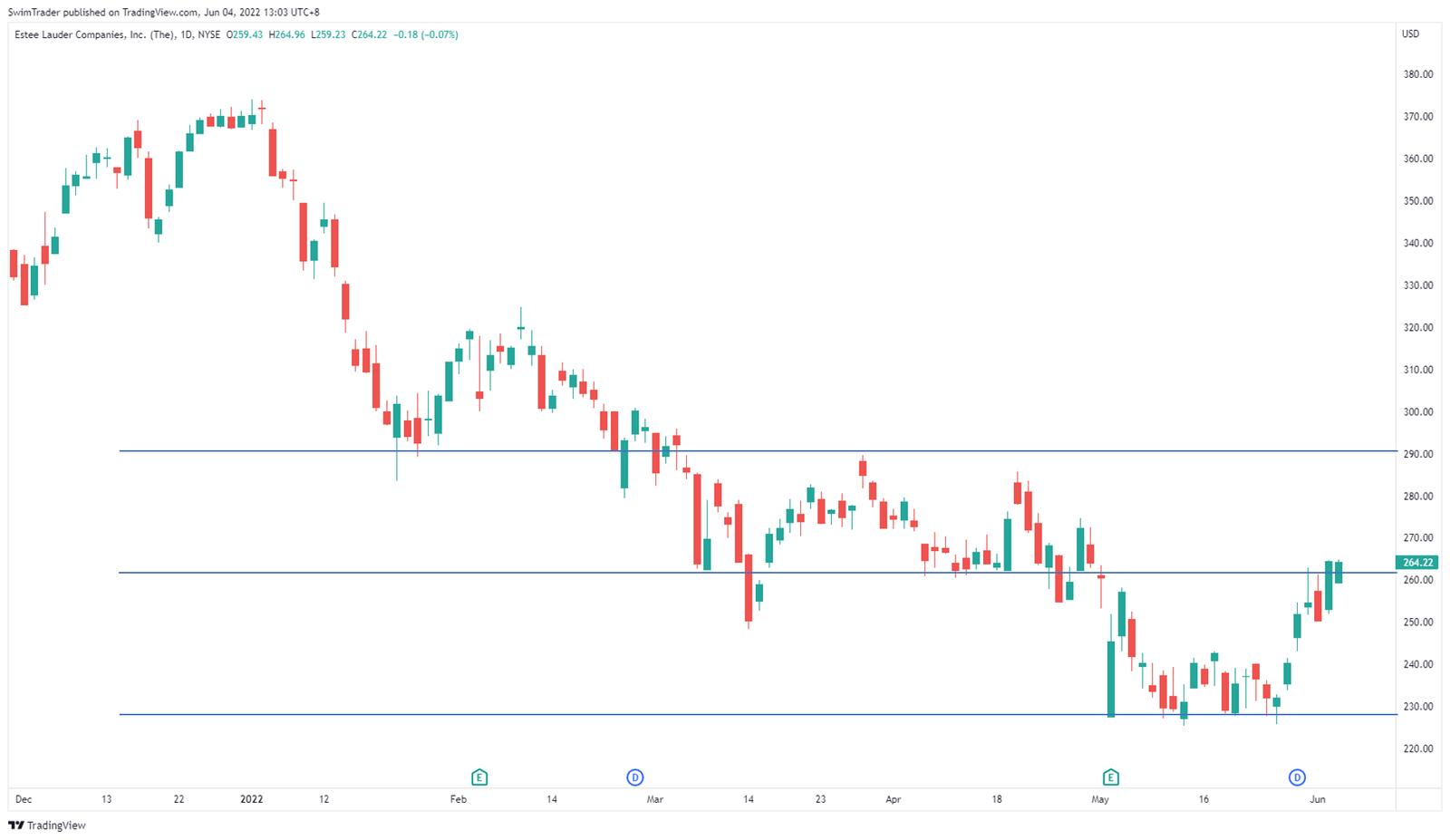

Key Price Levels

The very next step is to plot your support and resistance zones so that you can tell where the key price levels are and if the price of EL is about to turn.

Plotting the key price levels of EL, you can see that its immediate resistance zone is around $290 while its immediate support zone is around $262.

Further lower, there’s another support zone at $228.

What can you interpret from these key price levels?

If the market participants remain bullish on EL, its price can reach around $290. Its price may even briefly pull back to around $262 before heading higher.

On the other hand, if the market participants are bearish on EL, its price could drop to about $228.

However, since EL is in a new uptrend, I think that the price of EL should continue to head higher towards $262 after a brief pullback.

The Strategy You Can Use To Trade EL

Here, you’ll be planning your entry, profit taking, and stop loss levels.

In every trading strategy, you must know your entry, profit taking, and stop loss levels to stay in business. Yes, trading is a business indicating that the strategy you use must be well formulated too.

Using The Art of Explosive Profits framework (AEP for short), I’d like for the price of EL to pull back to its support level around $98 before launching a fresh up move.

As its name suggests, you’ll be looking to catch an explosive move in a short period of time consistently.

In the AEP course, you’ll be coached on how to search for strong stocks like EL instead of relying on news and hear-say.

You’ll also become fluent in reading charts to shortlist stocks that are about to have an explosive move.

Finally, you’ll learn how to identify the optimized entry, stop loss, and take profit level to capture these explosive moves that you’ve been waiting for (in a safe manner, of course)!

Have a look at the AEP framework and add this explosive trading strategy to your arsenal to seize more trading opportunities.

Why Is EL The Stock Pick Of The Week?

![]()

Source: https://www.elcompanies.com/en

EL is the stock pick of the week because of multiple reasons.

It’s stronger than the overall US market. While the overall US market is stagnant, the price of EL has been rising.

Prior to EL’s downtrend, EL has proven its upward price movement to be explosive, with each move measuring a minimum of 4% in a short period of time. This is made more remarkable because of its share price and huge market capitalization.

Moreover, a fresh uptrend has been formed, providing you with ample opportunities and possibly enlarged profit.

Before you rush to buy EL, there’s something you need to know. I’m not a financial advisor, so please take what you’ve read here as edutainment.

Lastly all photos and images are from unsplash.com, pexels.com, pixabay.com, and tradingview.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#2 Never miss another market update; get it delivered to you via Telegram by clicking here

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!