Do you rely a lot on technology?

So much to the point where you’re unable to get a handful of basic things in life done without connectivity to the Internet?

I do.

It gets a little embarrassing to state the struggles I face when I’m not connected to the Internet.

As our reliance on technology grows, it’s little wonder that the share price of the core technology providers continue to perform even in a torrid month such as August.

Ok, I’m getting ahead of myself.

Shall we check out how last week’s swing trading opportunity, Marsh & McLennan (MMC), fared?

Marsh & McLennan’s share price continued to rise last week, reaching a peak at nearly $180.

Thereafter, its share price pulled back, ending the week at $195.77.

There’s still more room for this pullback, and I’d like to see it drop to ~$192 before applying The Art of Explosive Profits framework.

While we wait for that scenario to play out, let’s analyze this week’s swing trading opportunity: Cisco (CSCO).

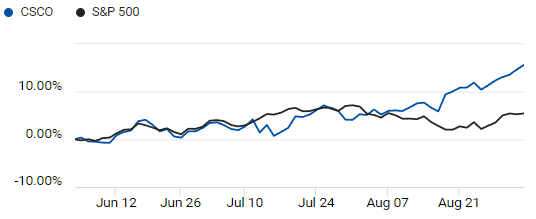

Performance Of US Stock Market vs Cisco (CSCO)

As shared briefly in the introduction, Aug was a terrible month for the S&P 500 and most stocks.

A 5.3% correction was experienced from peak to trough on the S&P 500 in Aug 23 while this technology stock defied gravity.

In the comparison chart above, you can tell that the share performance of Cisco has been beating the market hands down.

Why is this important?

You’re looking for a swing trading opportunity, therefore, you’ll want the stock you buy to be trending and bring you supernormal returns.

Without a hint of being able to get a supernormal return, you could be better off buying the S&P 500 for a swing trade instead.

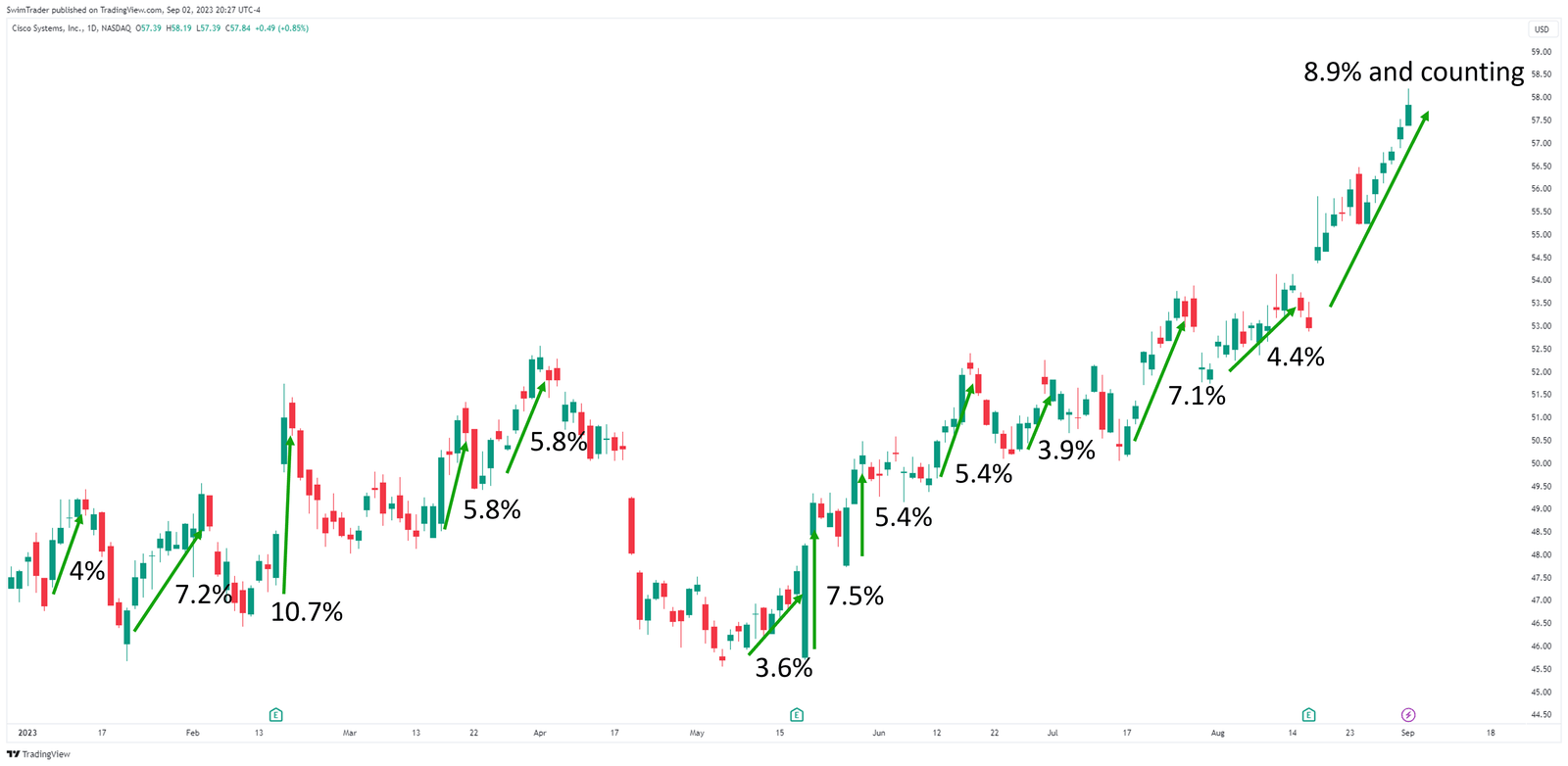

How Explosive Is Cisco (CSCO)?

The next characteristic you want from your stock is explosiveness.

This helps you decide whether the stock you’re eyeing on is worth your time and money.

Here, I’ve marked out the explosive up moves on the shares of Cisco.

In the recent 8 months, the shares of Cisco have exploded upwards 13 times!

Each time, its share price had shot up between 3.6% and 10.7%. This is highly impressive for a company that’s worth over $235b!

Knowing that the shares of Cisco are explosive in nature, is it time to buy them for a swing trade?

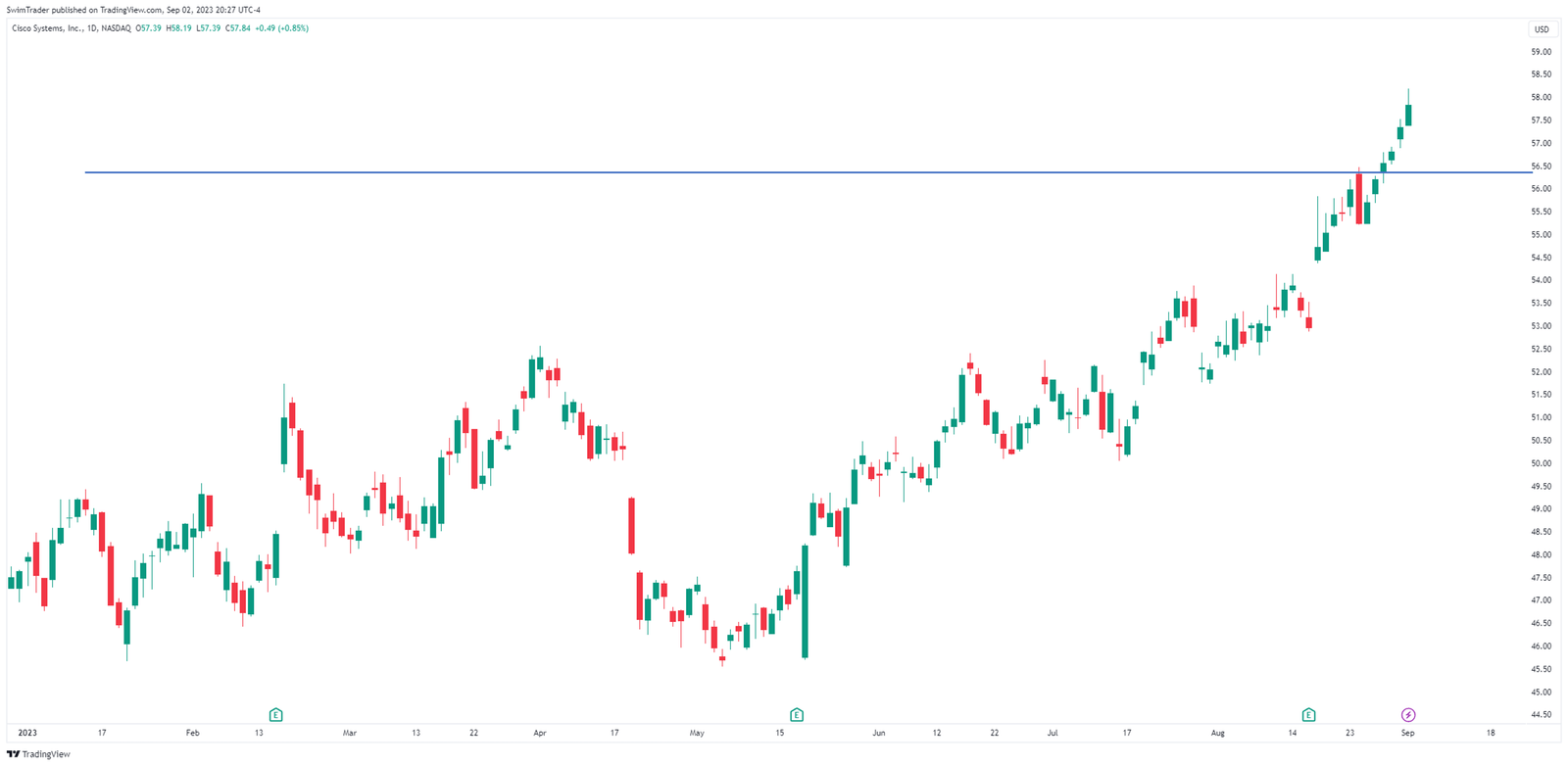

Key Price Levels

Before you hit the Buy order, it’s a good practice to uncover its key price levels. These key price levels are also commonly known as support and resistance zones.

This will help you know if you’re getting the stock at a favorable price.

Looking at the share price of Cisco, can you see a support zone at ~$56.50?

After a continuous rally for 1 week, a reversal could be happening soon. Hence, I’m not in a hurry to buy its shares for a swing trade.

The Strategy You Can Use To Swing Trade Cisco (CSCO)

After comparing the performance of CSCO with the broader US stock market, determining whether CSCO has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see CSCO pullback and bounce at around $56.50 before considering an entry for a swing trade.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to screen stocks for swing trading like CSCO.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Can you apply the AEP framework to provide you with a side income while working full time?

Yes, you can!

Come, have a look at the AEP framework and incorporate this explosive trading strategy into your arsenal to capitalize on more swing trading opportunities.

Why Is Swing Trading CSCO Worth It?

Source: investor.cisco.com/home/default.aspx

Despite the horrible performance of the S&P 500 in Aug 2023, the share price of CSCO soared!

Market participants are optimistic of this stock and this sentiment has not faded.

For a mega cap company, it had demonstrated its ability to explode in price for 18 times in the past 8 months alone!

While we wait for the setup, please keep in mind that I’m not a financial advisor, so please treat this as infotainment and conduct your own research.

Lastly, all images are from pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here.

#2 Get market updates delivered to you via Telegram by clicking here.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here.

Trade safe!