How many ways are there to profit from the stock market? Plenty.

There are some who are keen on investing. They employ fundamental analysis to buy stocks and hold them for years, if not decades. They plough through the financial statements of listed companies in search of undervalued stocks (aka bargains), study their management and leadership teams, and more. Wildly successful investors include Warren Buffett and Peter Lynch.

There are some others who are interested in making money through trading the stock market. They employ technical analysis by drawing trendlines, adding indicators, recognizing chart patterns, identifying candlestick patterns to profit from market trends. Traders hold stocks ranging from minutes to months. Paul Tudor Jones and Richard Dennis are wildly successful traders.

How else is an investor different from a trader?

Click here for an elaboration.

Within technical analysis, there’re a handful of trading strategies that you can use to profit from the stock market. One strategy that’s gaining popularity is swing trading.

#1 What Is Swing Trading?

Swing trading is a strategy that follows the trend of prices. Because prices don’t rise or fall indefinitely, it is important to know how to identify trends.

Here’s an example on the movement of prices:

NUE is in an uptrend. Did you also notice that prices move in waves (shown by the arrows in black)?

GILD is in a downtrend. Its price waves are shown by the black arrows.

#2 What Is A Swing?

In a bull market, prices are rising; prices are in an uptrend. A swing in an uptrend is an upward move. Depending on the timeframe of your charts and trades, a swing can last for minutes to weeks.

Swing trading is not bound to any timeframes. You can apply the technique of swing trading to your day trades (trades which are opened and closed within the day)!

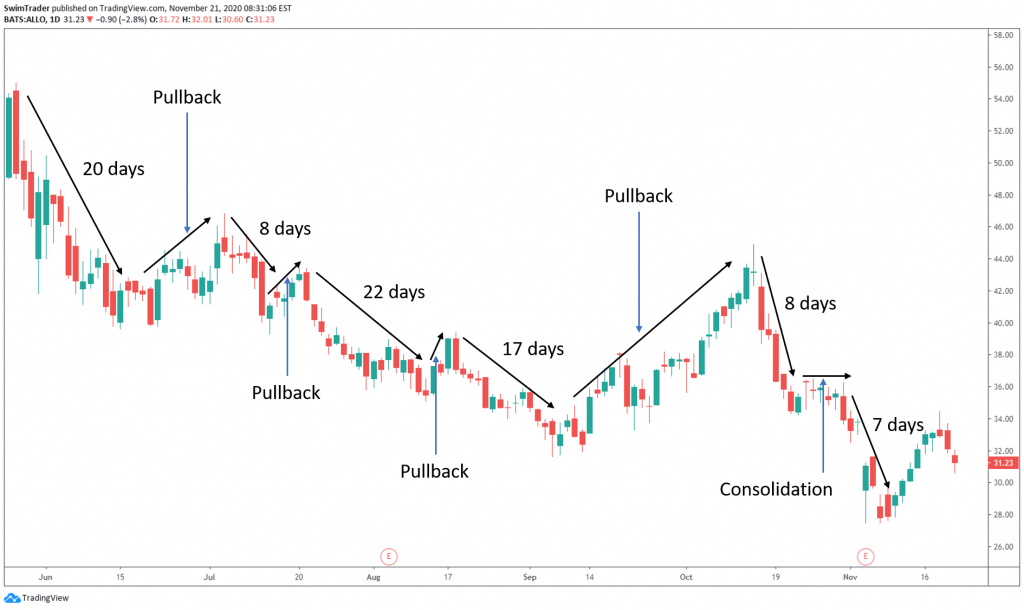

Any short downtrends are known as corrections or pullbacks. A stalled movement in prices is known as a consolidation.

On the contrary, a bear market is when prices are declining; prices are in a downtrend. A swing, therefore, is a downward move. A swing in a bear market also lasts for minutes to weeks, depending on your trading and charting timeframe.

Any short uptrends are known as corrections or pullbacks. A stalled movement in prices is known as a consolidation.

#3 Is Swing Trading Suitable For You?

Since swing trading isn’t confined to any timeframe, let’s set a default timeframe as a reference through this article. Let’s use the daily chart for swing trades.

The use of daily charts means that your trades will last for days to weeks. This is especially important if you have a day job and other commitments.

Is swing trading suitable for you? Swing trading is suitable if:

A) You have 2 hours over the weekends to plan your trades

B) You don’t wish to sit in front of your computer for long hours to watch the stock market

C) You wish to buy and hold for a few days to weeks

D) Even if you are a total beginner

Allow me to elaborate on each point.

A) You have 2 hours over the weekends to plan your trades

I know that weekends are precious. This is where technical analysis (TA) is helpful.

The central belief of TA is that events and news have been factored into price. Hence, studying charts is deemed to be sufficient.

This is good news as you’ll just need to spend about 2 hours on the weekends to look at charts and plan your trades.

You’ll need to look out for the following:

#1 Trend

#2 Consolidation

Then, form a watchlist and set price alerts. You’re now done with trading and can enjoy your weekend!

B) You don’t wish to sit in front of your computer for long hours to watch the stock market

When the stock market is open on a weekday, you don’t have to be glued to your computer. All you need is to spend just 30 to 60 mins each day.

Why is 30 to 60 mins necessary? When should you watch the market?

I highly encourage you to watch the opening 30 to 60 mins of the stock market. Economic data is released in this window which sets the tone for the day.

Having done your homework over the weekend, you’ll need to see if the stocks you’re monitoring are going the way as planned. If they are, enter a trade. If not, you can go do your own things.

C) You wish to buy and hold for a few days to weeks

You have commitments. You wish to spend time with your family (esp when you have a newborn). You want to hang out with your friends. That is, you don’t want to have to keep an eye on your trades all the time.

Most importantly, you want to build your wealth in a consistent manner (with lowered risks), so that you don’t lose sleep.

Swing trading the daily charts allow you to take your eyes off the market for most of the time for other important things.

The use of position sizing and a stop loss protect your trading capital so that you don’t lose your hard-earned money overnight.

Risk can be greatly reduced by identifying candlestick and chart patterns and riding on trends too. Remember to always trade with the trend!

D) Even if you are a total beginner

Swing trading is not rocket science. Though experience is the best teacher, experience can be picked up easily.

On the contrary, day trading is more challenging due to the high pressure stemming from the short timeframes of trades. You got to make decisions on the fly, be extremely decisive, and enter your trades fast. There is little to almost no time for hesitation.

Because of the pace of swing trading, you can afford to pause for thinking.

Swing trading is like you’re driving a Toyota. You just need a driver’s license and average response speed.

Here’s What You’ve Learnt Today

#1 Swing trading follows trends

#2 Swing trading isn’t limited to any particular timeframe

#3 Swing trading is friendly to beginners

#4 The suitability of swing trading

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!